Ethan Ziegler, American University

Cite as: Ziegler, Ethan. 2024. “The Association Between Food Surplus Costs and Retail Prices”. Food-Fueled, 1, e00005. doi:10.57912/25642092.

web address: https://edspace.american.edu/foodfueled/issues/volume-i/the-association-between-food-surplus-costs-and-retail-prices/

Please click here to download the piece as a PDF. The text is also listed below.

Abstract

Little research exists on the relationship between food surplus costs and retail prices. The United States (U.S.) spends about $2 trillion each year on food, with the total value of all surplus food surmounting $400 billion. In most industries, surplus has a negative correlation with price; however, available data demonstrates that increases in food surplus costs follow similar trends to increases in prices. This study aims to assess surplus costs at the retail level of the supply chain, combining them with data on the defined factors influencing food costs including agribusiness, transportation, wholesale trade, and energy. A random effects panel regression is conducted, analyzing the prices and costs of 35 food types over the years 2010-2015. Results illustrate that a 1% (13%) increase in surplus costs correlates to a 0.36% (3.6%) increase in prices. Another interpretation is that a $175 million increase in surplus costs is related to a $0.36 increase in average retail price of the observed food types. There were many limitations with this paper, much of which is related to data availability, but this provides numerous outlets for further research into the topic. This study demonstrates how reducing food waste in America may have economic outcomes that would benefit consumers in the form of decreased food prices.

Introduction

Over the past decade, an influx of information regarding food waste has been publicized by governments and researchers around the world, entering the discourse surrounding the efficient and sustainable production and consumption of goods. Food waste is heavily associated with numerous issues — both in the U.S. and on a global scale — including hunger, poverty, excess land and water usage, and greenhouse gas emissions. One major problem with the production of surplus foods that is rarely discussed is the costs and foregone value of those foods. In 2021, food expenditures in the U.S. amounted to more than $2 trillion (Martin, 2023). In tandem, the costs of surplus food in the same year reached over $440 billion (ReFED, 2023).

A myriad of research exists examining the factors that influence food prices, while none is available regarding how surplus costs impact prices. In most industries surplus production and its costs reduce prices, but from visualizing available data this trend does not occur with food, with the two following a similar pattern. From this, I hypothesize that surplus costs contribute by minorly increasing food prices, based on their positive graphical relationship.

To determine the extent of their association, multiple random effects panel regressions were conducted. The series spans from 2010-2015 and examines 35 major food types; data on average retail price is taken from the Bureau of Labor Statistics; data on retail surplus costs is taken from ReFED; and data on the defined factors affecting food prices (agribusiness, transportation, energy, etc) is taken from the USDA’s Food Dollar Series. The main equation for this series is a log-log equation where the retail price and surplus costs variables are log-transformed. Results demonstrate that a 1% increase in surplus costs is associated with a 0.13% increase in retail prices, or a 13% increase in surplus costs results in a 3.6% increase in prices.

This study has numerous limitations. Data from the Food Dollar Series does not include costs for specific food types, but rather costs for broader food categories. Additionally, the data was only available for the years 1997, 2002, 2007, and 2012, so aggregation was necessary, with 2007 data being applied to 2010 and 2011 and 2012 data being applied to 2012-2015. This resulted in significant multicollinearity between many of these variables and reflects in the statistical significance of some of the regression results. Nonetheless, such data offers serious potential for future research. The Bureau of Economic Analysis has IO data which, with intense calculation, could provide annual data for the defined factors affecting food prices. This study is only examined at the national level, one could analyze differences by state or region. This paper also only assesses the retail level of the supply chain, and there is potential for waste at other levels influencing prices.

This paper is structured into eight sections. Following this introduction is a background and literature review section, which provides important information on the global and domestic state of the food system in relation to hunger, resource consumption, and waste, and examines a variety of literature on food waste, the circular economy, and food prices. The data and methodology section outlines the data used in this study and how the study was conducted. The results section showcases a series of regression results, with the discussion section analyzing these results, and acknowledging the limitations to this paper, as well as potential avenues for future research. After the conclusion and references, an appendix is included to define some of the language of this paper and showcase additional regression results.

Background and Literature Review

2.1 Background

In a time when the United Nation’s Sustainable Development Goals classifies “zero hunger” as its second most important objective, estimates of the United States wasting 30-40% of its total food supply are perplexing (FDA, 2023). Although this initiative is geared towards low- and middle-income nations, hunger is still a major issue in the U.S.; around 44 million people, or 10% of the population, are food insecure, 13 million of which are children (Feeding American, 2023). One of the major issues associated with food scarcity in America is food deserts, which occur when urban or rural populations live more than 1 or 10 miles, respectively, away from a supermarket or grocery store (Ploeg, 2011). There is a direct relationship between earning an income below the poverty line and having low access to healthy food options nearby (George, 2021). Although the number of individuals living in low-access areas decreased from 6.8 to 5.6% from 2010 to 2016, the total number of low-income communities increased by over 5%, resulting in a net increase of low-access communities by 0.36% during this time. Racial disparities in these metrics cannot be ignored, with an additional 30% of non-white residents living in low-access communities relative to their white counterparts (Karpyn, 2019). As income inequality persists and poverty rates increase, food security will become a bigger issue across the nation.

Although food waste is a global issue with numerous ramifications, the U.S. is one of the largest contributors to the issue. A recent UN report states that on average, 1.026 billion tons of food, or 17% of total global production, are wasted each year (Marchant, 2023). According to the EPA’s 2019 Wasted Food Report, the U.S. contributed 66.2 million tons of waste to that value (EPA, 2019). In addition to associations with food scarcity, food waste is the driver of many interlinked social, economic, and environmental issues worldwide. In 2021, surplus food cost the U.S. an estimated $444 billion (ReFED, 2023). The average family of four in the U.S. spends between $1,350 and $2,275 on food they will end up wasting (Columbia Climate School, 2019). Food production, preparation, and transportation are also resource- and energy-intensive processes. Agriculture accounts for 80% of freshwater consumption in the US, and in 2021 alone 22 trillion gallons of water were wasted as a result of surplus food (ReFED, 2023). Agricultural practices also utilize over 50% of land area in the U.S.; not only does all this land then require disproportionate amounts of water, but it could be put to other uses. Food production is also highly energy intensive, as over 10% of the total U.S. energy budget is spent towards transporting food from farms to consumers (Columbia Climate School, 2019). Globally, around 10% of GHG emissions are linked to wasted food, with the US releasing around 375 million metric tons of CO2e from surplus food every year (Gikandi, 2021).

2.2 Literature Review

Significant research exists analyzing the problems associated with food waste and their potential solutions. Many governments and international bodies — including the Food and Agriculture Organization of the United Nations — only began recording data on food waste in 2010. Although the issues associated with surplus food are known, the scope of the problem was unfamiliar to many. With new information being released annually, there is an influx of research and response on how to perceive, minimize, manage, and solve food waste. With much of the new information assuming different approaches, the publication of Papargyropoulou (2014) redefined how researchers and policymakers should ponder the issue. With much solution-based research at the time of publication suggesting merely waste management itself, which only occurs at the tail-end of the supply chain, Papargyropoulou and colleagues proposed a new approach, modernizing the discourse around food waste. Accounting for environmental and social factors, the hierarchy for minimizing and managing food waste, from most to least advantageous: prevention (avoiding surplus production), re-use (through redistribution networks and food banks/donations), recycle (animal feed and composting), recovery (preserving energy through anaerobic digestion), and disposal (landfills). This hierarchy has driven most research on food waste and its solutions since its publication (Papargyropoulou, 2014).

The concept of the circular economy is critical to this hierarchy. Defined by the Ellen MacArthur Foundation, the circular economy “is a system where materials never become waste and nature is regenerated….Products and materials are kept in circulation through processes like maintenance, reuse, refurbishment, remanufacturing, recycling, and composting” (Ellen MacArthur Foundation, 2012). The circular economy is often a key theme for many perspectives on food waste. A 2023 literature review combining 333 papers intersecting food waste, the circular economy, and supply chain management found the majority of resources on food waste solutions involve implementing a circular approach to management (Viscardi, 2023). Another review, highlighting specific food waste solutions, found that many bio-based green practices, such as anaerobic digestion, composting, and enzymatic treatment all valorize food waste and apply principles of the circular economy. The authors also acknowledge that much information on many of these practices, such as upfront costs and valorization techniques, is still unknown or unavailable, emphasizing the need for further research into sustainable waste solutions (Usmani, 2021).

Extensive research has been conducted on the determinants of food prices throughout the world. A study assessing the factors influencing food price inflation in Finland using a vector error-correction model found that a long-run equilibrium relationship between the prices of food, energy, agricultural commodities, and wages, over the years 1995 through 2010. Farm prices played the largest role, while labor costs in the retail sector and energy prices also had significant impacts (Irz, 2013). Further research discussing the relationship of food and energy costs discovered that information shocks originating from the oil market, in addition to the CPI, lending rate, and exchange rate, have a direct effect on volatility in the food market (Fasanya, 2018). Although energy is a significant cost in the food industry, especially when one accounts for demand at the beginning of the supply chain, it is often not the main determinant of food prices. For many middle-income countries that import a sizeable portion of their food, the costs associated with trade play a critical role in pricing. A study examining food price increases in Turkey, which rose faster than CPI, found that exchange rates played a critical role in price increases (Oral, 2023). Another analysis utilizing an error-correction model found that GDP, exports, imports, and dependence on the agricultural sector all had statistically significant short- and long-run impacts on food price inflation in Pakistan (Joiya, 2013). Disease outbreaks may also signify a decrease in prices. A 2022 study emphasizing the fragility of the U.S. food system using partial equilibrium optimization-based modeling found that an outbreak of mad-cow disease would result in a 24% decrease in cow meat production and a subsequent 4% decrease in prices (Moynihan, 2022).

There is little research available on if surplus costs influence food retail prices. A recent study examining food price inflation in the United States found that there is a strong correlation between food price increases and an increase in the money supply, more than historically noted. The authors used a series of covariance stationary SVARs to estimate their model, which included relevant supply-side and demand-side variables. One of the main limitations of the study is based on the model, the established relationship is not causal, similar to the study presented in this paper (Adjemian, 2023). According to classical economic theory, a surplus in supply should result in a decrease in price, yet over time food surpluses and prices have both increased. This should indicate that the costs of food surplus contribute to retail prices, but in a way contrary to traditional theory.

Methods

3.1 Data

The main independent variable in this study is food surplus costs. Data on this was obtained from ReFED, a national non-profit organization that compiles and analyzes data on food waste across America. ReFED collects and estimates data from numerous outlets, including the USDA, the WWF, Nielsen, and the Food Waste Reduction Alliance. ReFED’s Insight’s Engine houses data on total quantities of food waste and data on food waste solutions and their impact. In terms of the data specifically used in this paper, ReFED has data sheets on State and National Food Surplus. These spreadsheets include data on the tons of food supplied, surplus, and wasted, the tons of food surplus sent to different waste management techniques, and the water and emissions footprint from food production. ReFED examines these variables at both national and state levels, by supply chain level (Farm, Manufacturing, Retail, and Residential) and food type (over 300 food types). All data is available for the years 2010-2021. The specific variable from ReFED’s data used in this analysis is “U.S. Dollars Surplus” which from their methodology estimates the overall costs associated with the production of surplus food.

The complementary dependent variable data is that of retail prices of foods in the U.S. This data was gathered from the Bureau of Labor Statistics. The Mid-Atlantic Information Office holds a data series titled “Average Retail Food and Energy Prices.” In particular, the U.S. is divided into four regions, Northeast, South, Midwest, and West, and average food prices for a number of products are available for each region. Each of the four datasets includes a section for “U.S. city average,” which is the average national price for the available food types. Data is accessible for 75 food and beverage types, and 35 are used in this paper. Data is available for years ranging from 1980 through 2023; this study only examines data from 2010-2015 resulting from limited access to other necessary data.

Retail food prices are influenced by a multitude of factors. The USDA’s Economic Research Service conducts a yearly analysis of the distribution of the costs of purchased food. They account for an abundance of factors, with the major ones being farm production, processing, packaging, transportation, wholesale trade, retail trade, energy, finance, and advertising. Despite the accuracy of this data, there are many limits to its usage in this study. Data of the defined costs is not available for specific food types, but rather food categories; data on eleven food categories are applied to the 35 food types. Additionally, this data is only available for “reference years” 1997, 2002, 2007, and 2012. For this study, data from 2007 is aggregated over the years 2010 and 2011, and data from 2012 is aggregated over the years 2012-2015.

In my analysis, I wish to include surplus costs into this mix, and determine how food surplus may impact food costs for consumers. There are also other factors that may contribute to food prices, such as geopolitical conflicts, government policy, disease, and availability of natural resources; these, however, are difficult to measure, and for that purpose are excluded from this study.

3.2 Methodology

The research for this paper is organized as panel data, with 35 identification numbers being assigned to the 35 food types being studied. Multiple random effects regressions were run to determine the impact of different food cost factors (specifically surplus costs) on food prices. By conducting a panel series regression, this study controls for time fixed effects. Food prices and costs have increased at varying rates over the observed years, so the data is non-stationary. Additionally, by controlling for time, the effects of inflation on retail prices are captured, preventing the need to include a CPI variable as a determinant for price. Analyzing the effects of and over time is not among the goals of this study, so a time fixed effects regression is viable.

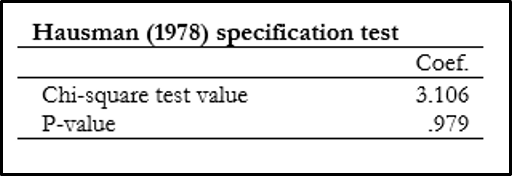

As shown in Figure 4, a random effects regression was run because of a failure to reject the null hypothesis of the Hausman Test. There were many benefits to running a random effects regression, as it allowed for the inclusion of time invariant variables, a more complete estimation with a higher R2, and no loss in degrees of freedom.

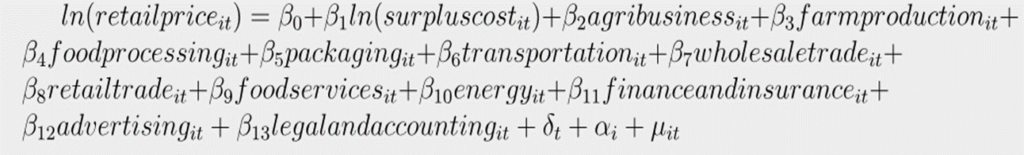

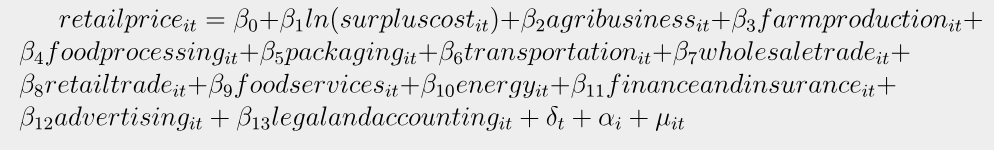

The main equation of estimation involves a log-transformation of both the dependent variable (average retail price) and the main independent variable (surplus costs). Including all the other determinants of food prices, the driving equation behind the results of the research is:

with δt representing unobservable macroeconomic shocks, αi representing individual heterogeneity, and µit representing time shocks. Multiple variations of this equation with different groupings of defined food cost variables were conducted to uphold the validity of the reported surplus cost coefficient.

Results

4.1 Graphing the relationship between retail prices and surplus costs

One of the main motivations for administering this analysis was the known related trends in food prices and surplus costs.

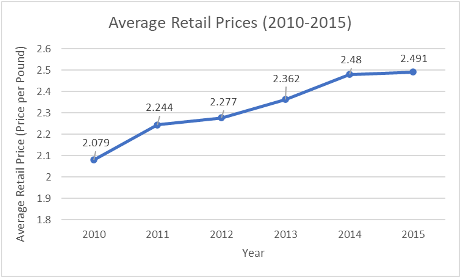

Figure 1: The increase in average retail costs (2010-2015).

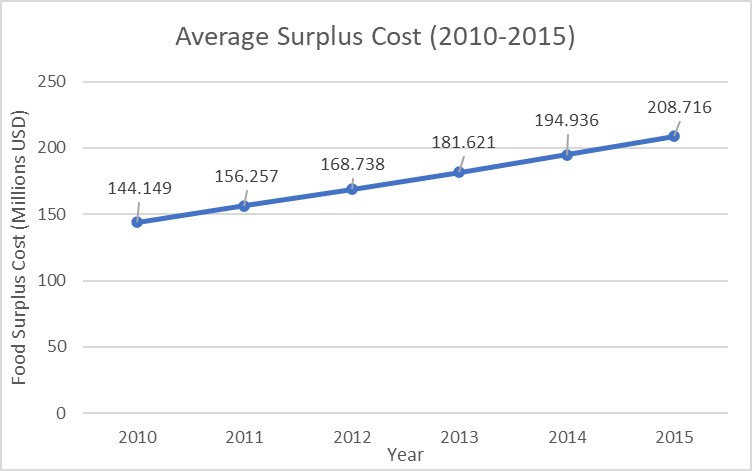

Figure 2: The increase in average surplus costs (2010-2015).

The average retail price of all food types present in this study follows an increasing trend between the years 2010 and 2015. The steepest increase occurs between 2010 and 2011, with varying degrees of growth occurring throughout the remaining years. Retail prices increase only slightly between 2014 and 2015. Surplus costs rise steadily between the tested years, following a near linear trend. Although the graphs do not follow the same annual trends, they have similar slopes. The slope of Figure 1 is y=0.0824x + b, while the slope of Figure 2 is y=0.129x + b. This shows how the two increase at similar rates over time.

4.2 Correlation Matrix

The first calculation of importance is a correlation matrix between all involved variables. All regressions and calculations were conducted in STATA, with outputs stylistically transferred in Microsoft Word thanks to coding from Dr. Attaullah Shah of the Institute of Management Sciences of Peshawar, Pakistan.

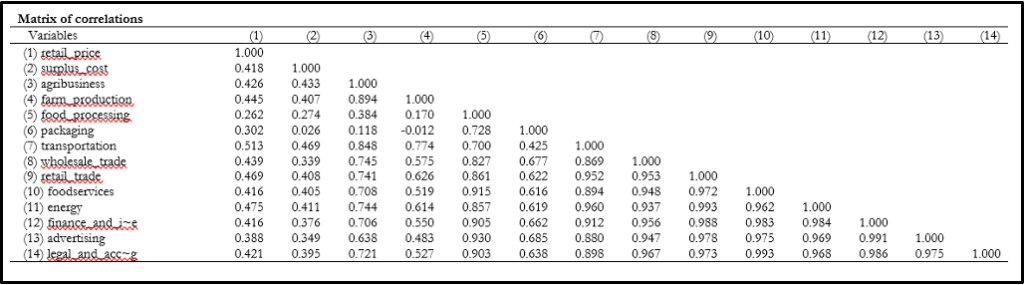

Figure 3: Correlation matrix of all variables involved in analysis.

The correlation matrix above illustrates the relationship between all the variables utilized in this study. The two most important variables in this study are retail price and surplus costs; fortunately, correlations between these variables and other variables in the research are not very high, with many coefficients averaging around 0.4. Although this is a moderate correlation, it is not high enough to warrant inefficient results. Unfortunately, many of the other variables have high correlations with one another. For example, finance, insurance, and advertising costs have a positive correlation of 0.991. As will be demonstrated, this heavily contributes to statistical insignificance in regression results. There is one negative correlation which warrants reporting, and that is -0.012 correlation between packaging and farm production; this makes sense in the context of fruits and vegetables requiring limited packaging, but many meat, poultry, and dairy products, which also originate at the farm level, require significant packaging. Aside from this, all the correlations make sense considering the relationships between these industries.

4.3 Hausman Test

Following this, a Hausman Test was conducted to confirm the usage of a random effects regression relative to a fixed effects regression. The Hausman test assumes a null hypothesis that a random effects regression is preferred because of its higher efficiency.

Figure 4: Hausman Test.

To reject the null hypothesis of using a random effects model, the test must output a p-value less than 0.05 (in relation to a 95% confidence interval). The p-value of 0.979 is greater than 0.05, indicating the null hypothesis could not be rejected and random effects is the preferred model.

4.4 First Regression: Both key variables log-transformed

Based upon the Hausman Test, a random effects regression was run using the equation found above.

Figure 5: Regressing ln(retail price) on all variables, including ln(surplus cost)

Regression results

| lnrp | Coef. | St.Err. | t-value | p-value | [95% Conf | Interval] | Sig | ||||

| lnsc | .13102 | .05246 | 2.50 | .0125 | .0282 | .23383 | ** | ||||

| agribusiness | -.00016 | .00009 | -1.75 | .08049 | -.00033 | .00002 | * | ||||

| farm_production | -.00001 | .00001 | -1.07 | .2832 | -.00004 | .00001 | |||||

| food_processing | -.0001 | .00005 | -1.96 | .05033 | -.0002 | 0 | * | ||||

| packaging | -.00002 | .00004 | -0.40 | .69196 | -.0001 | .00007 | |||||

| transportation | -.00031 | .00062 | -0.51 | .61334 | -.00152 | .0009 | |||||

| wholesale_trade | -.00004 | .00009 | -0.39 | .69349 | -.00021 | .00014 | |||||

| retail_trade | .00007 | .00015 | 0.49 | .62387 | -.00021 | .00036 | |||||

| foodservices | .00725 | .00418 | 1.73 | .0831 | -.00095 | .01545 | * | ||||

| energy | .00071 | .00037 | 1.91 | .05592 | -.00002 | .00144 | * | ||||

| finance_and_insura~e | -.00043 | .00038 | -1.13 | .25837 | -.00117 | .00031 | |||||

| advertising | -.00103 | .00055 | -1.85 | .06441 | -.00211 | .00006 | * | ||||

| legal_and_accounting | -.00002 | .00075 | -0.02 | .98314 | -.0015 | .00146 | |||||

| 2010b | 0 | . | . | . | . | . | |||||

| 2011 | .05586 | .01159 | 4.82 | 0 | .03314 | .07858 | *** | ||||

| 2012 | -.04412 | .0816 | -0.54 | .58871 | -.20406 | .11582 | |||||

| 2013 | -.02127 | .08272 | -0.26 | .79704 | -.1834 | .14085 | |||||

| 2014 | .01376 | .08596 | 0.16 | .87279 | -.15472 | .18225 | |||||

| 2015 | .01103 | .08922 | 0.12 | .90159 | -.16383 | .18589 | |||||

| Constant | -.29084 | .25327 | -1.15 | .25084 | -.78724 | .20557 | |||||

| Mean dependent var | 0.65645 | SD dependent var | 0.62961 | ||||||||

| Overall r-squared | 0.40299 | Number of obs | 210 | ||||||||

| Chi-square | 2853.72369 | Prob > chi2 | 0.00000 | ||||||||

| R-squared within | 0.54387 | R-squared between | 0.40076 | ||||||||

| *** p<.01, ** p<.05, * p<.1 | |||||||||||

The above table displays the results from regressing the log-transformed retail price variable on the log-transformed surplus cost variable, all variables representing the determinants of food prices, and dummy variables placing each year relative to 2010. This regression categorizes surplus costs as the main explanatory variable, controlling for the effects of all other price determinants. Log-transformed surplus cost has a positive relationship with retail prices, with a coefficient of 0.131 and a p-value of 0.013, classifying it as statistically significant. Many variables surprisingly have a small, but negative relationship with food prices. The time variables show a decrease in retail prices between the years 2012 and 2013, relative to 2010, followed by two years of increasing prices. Unfortunately, almost every variable suffers from statistical insignificance, likely as a result of the high correlation between variables. The appendix below includes many other variations of this same regression to prove the validity of the surplus cost coefficient.

Because of significant multicollinearity in the preliminary model, multiple reduced regressions were conducted, pinning different variables together to avoid statistical insignificance in results. The table below presents the results of five reduced regressions. The equations are:

- ln(retail price) = β0 + β1ln(surplus cost) + β2foodprocessing + B3packaging + β4transporation + β5energy + δt + αi + µit

- ln(retail price) = β0 + β1ln(surplus cost) + β2foodprocessing + B3packaging + β4agribusiness + β5advertising + δt + αi + µit

- ln(retail price) = β0 + β1ln(surplus cost) + β2foodprocessing + B3packaging + β4wholesaletrade + δt + αi + µit

- ln(retail price) = β0 + β1ln(surplus cost) + β2wholesaletrade + B3farmproduction + δt + αi + µit

- ln(retail price) = β0 + β1ln(surplus cost) + β2foodservices + B3farmproduction + δt + αi + µit

Next to each variable are three values; the top value is the coefficient, the middle value is the z score, the bottom value is the p-value. The within and between R2 values and the rho are included at the bottom for each regression.

Figure 6: Regressing ln(retail price) on many five combinations of variables

Regression results

| lnrp | (1) | (2) | (3) | (4) | (5) |

| lnsc | .13743 2.90 0.004 | .12157 2.08 0.038 | 0.12294 2.39 0.017 | .012151 2.22 0.027 | .13221 2.25 0.024 |

| food_processing | -.00003 -4.41 0.000 | -.00001 -1.94 0.052 | -0.00001 -2.79 0.005 | * | * |

| packaging | .00003 0.63 0.531 | .00007 1.38 0.167 | 0.00007 2.18 0.029 | * | * |

| transportation | .00011 2.10 0.036 | * | * | * | * |

| energy | .00018 2.89 0.004 | * | * | * | * |

| agribusiness | * | .00005 2.52 0.012 | * | * | * |

| advertising | * | .00016 1.34 0.179 | * | * | * |

| wholesale_trade | * | * | 0.00003 4.88 0.000 | .00002 2.85 0.004 | * |

| farm_production | * | * | * | .00002 2.53 0.011 | .00002 2.89 0.004 |

| foodservices | * | * | * | * | .00045 1.23 0.218 |

| 2010b | . | . | . | . | . |

| 2011 | .05539 4.84 0.000 | .05654 4.74 0.000 | 0.05644 4.82 0.000 | 0.05654 4.66 0.000 | .05577 4.62 0.000 |

| 2012 | .04725 2.90 0.004 | .01961 0.91 0.362 | .01821 0.94 0.342 | .01109 0.55 0.585 | .01231 0.48 0.631 |

| 2013 | .06970 3.88 0.000 | .04304 1.91 0.056 | 0.0156 2.26 0.024 | .03452 1.76 0.078 | .03509 1.48 0.138 |

| 2014 | .10437 5.49 0.000 | .07863 3.47 0.001 | .07706 4.52 0.000 | .07011 3.88 0.000 | .07006 3.41 0.000 |

| 2015 | .10128 4.94 0.000 | .07641 3.36 0.001 | 0.07477 4.64 0.000 | .06790 3.88 0.000 | .07626 3.48 0.001 |

| Constant | -.51815 -1.97 0.049 | -.20562 -0.76 0.446 | -0.11633 -0.45 0.654 | -.18023 -0.63 0.528 | -.25739 -0.86 0.388 |

| Within R2 Between R2 rho | 0.5399 0.3267 0.9876 | 0.5070 0.2497 0.9883 | 0.5353 0.2379 0.9890 | 0.5261 0.2470 0.9885 | 0.5099 0.2451 0.9885 |

The results of this regression show how the effect of surplus cost on retail price changes when placed with different variable combinations. It also provides a more accurate coefficient for numerous variables, whose coefficients are statistically insignificant in the main regression.

4.5 Second Regression: Only one log-transformed variable

Another regression that was run to present this study’s findings differently was using the retail price variable in its present form, while log-transforming the surplus cost variable. The equation for this regression is:

Figure 7: Regressing retail price on ln(surplus cost) and all other variables

Regression results

| retail_price | Coef. | St.Err. | t-value | p-value | [95% Conf | Interval] | Sig | ||||

| lnsc | .36601 | .11585 | 3.16 | .00158 | .13895 | .59307 | *** | ||||

| agribusiness | -.00054 | .00019 | -2.90 | .00368 | -.00091 | -.00018 | *** | ||||

| farm_production | -.00006 | .00003 | -1.79 | .07325 | -.00013 | .00001 | * | ||||

| food_processing | -.00038 | .00009 | -4.19 | .00003 | -.00055 | -.0002 | *** | ||||

| packaging | .00016 | .00007 | 2.30 | .02134 | .00002 | .0003 | ** | ||||

| transportation | -.00138 | .00089 | -1.54 | .12243 | -.00313 | .00037 | |||||

| wholesale_trade | -.00015 | .00012 | -1.19 | .2348 | -.00038 | .00009 | |||||

| retail_trade | .00024 | .00023 | 1.03 | .3029 | -.00021 | .00069 | |||||

| foodservices | .02576 | .00765 | 3.37 | .00076 | .01077 | .04074 | *** | ||||

| energy | .00253 | .00069 | 3.69 | .00022 | .00119 | .00388 | *** | ||||

| finance_and_insura~e | -.00215 | .00065 | -3.32 | .00089 | -.00342 | -.00088 | *** | ||||

| advertising | -.00329 | .00101 | -3.25 | .00116 | -.00527 | -.0013 | *** | ||||

| legal_and_accounting | .00169 | .00091 | 1.86 | .06335 | -.00009 | .00348 | * | ||||

| 2010b | 0 | . | . | . | . | . | |||||

| 2011 | .13773 | .04156 | 3.31 | .00092 | .05628 | .21918 | *** | ||||

| 2012 | -.33674 | .13975 | -2.41 | .01597 | -.61064 | -.06283 | ** | ||||

| 2013 | -.27328 | .13271 | -2.06 | .03948 | -.53339 | -.01316 | ** | ||||

| 2014 | -.1768 | .13268 | -1.33 | .18268 | -.43685 | .08324 | |||||

| 2015 | -.18608 | .13597 | -1.37 | .17114 | -.45258 | .08041 | |||||

| Constant | -.05543 | .44045 | -0.13 | .89985 | -.91869 | .80783 | |||||

| Mean dependent var | 2.32230 | SD dependent var | 1.40231 | ||||||||

| Overall r-squared | 0.51922 | Number of obs | 210 | ||||||||

| Chi-square | 4443.59273 | Prob > chi2 | 0.00000 | ||||||||

| R-squared within | 0.51700 | R-squared between | 0.51935 | ||||||||

| *** p<.01, ** p<.05, * p<.1 | |||||||||||

The above output illustrates the results of regressing retail price on the log-transformed surplus cost variable and all other defined costs associated with food prices. Eleven variables exhibit statistically significant coefficients, and seven variables are statistically insignificant. There are again a surprising number of variables that are negatively correlated with price, and the results show a decrease in price over the years relative to 2010 (despite this not being represented in the data itself).

Discussion

5.1 Interpretation of Results

The main regression, in which both key variables are log-transformed, can be interpreted as reading that a 1% increase in food surplus costs is associated with a 0.13% increase in food retail prices. This can also mean that a 13% increase in surplus cost correlates to a 3.6% increase in prices. As a reiteration, the surplus cost data in this sample only includes surplus at the retail level of the supply chain. If a retailer’s surplus stock of food increased by 13% consumers would pay the price with retail prices that are 3.6% higher. Although there is no incentive for retailers to increase their surplus, as it will require extra labor and additional costs, it is interesting to note how much of an effect food surplus has, at this level in the supply chain, on prices. Figure 6 displays a more accurate reading of the impact of many variables on food prices, as much of the multicollinearity featured in Figure 5 is avoided. Regardless of the variable combination, the ln(surplus cost) variable remains around 0.13, providing evidence of its significance. Although there is still some statistical significance featured in these results, many of the coefficients are accurate and remain similar regardless of the regression.

The second regression exhibits how a 1% increase in surplus costs is related to a $0.0036 increase in retail prices. This may also be read as a $1.75 million increase in surplus costs results in the price of food rising by about a 1/3 of a cent, or a $175 million increase in costs leads to a $0.36 rise in prices. Although this seems small, considering all the factors influencing food prices, it can be said that there is a high association between rising surplus costs and rising prices. This regression again includes negative coefficients, many of which are statistically insignificant. Similar to the first regression, when different combinations of variables were run to reduce collinearity, the results were more accurate. These results are not included in this paper.

5.2 Limitations

Numerous roadblocks were faced throughout conducting this research, and as such this analysis has some limitations. Data on food waste is scarce, with accessible data only dating back to 2010. With such a limited supply of data, the possibility of studying it in varying ways, particularly over time, is limited to a certain capacity. This particularly became an issue when placing surplus costs relative to the other defined costs impacting food prices, with the most recent year in that dataset being 2012.

The USDA’s Food Dollar Series approaches the distributed costs of food in many ways, and it overall provides a variety of concrete data to show the factors influencing prices. Nonetheless, all the yearly data that is accessible combines every food type together (i.e., the farm production costs for apples are the same as cookies and the energy costs for ground beef are the same as coffee). Although this would have provided me with annual data to match my annual surplus cost and retail price data, I would have had to entirely abandon degrees of freedom in my analysis, resulting in inefficient results. To have variation within this data, I used series data for costs within food categories (i.e., fresh fruits, poultry, processed dairy products, etc). Although this was not as specific as food types (i.e., bananas, chicken breast, and butter) found in the retail price and surplus cost data, it allowed for more variation, and thus degrees of freedom. The main issue with using this data, however, was that it was not annual data, and the years available did not match the years for the retail price and surplus cost data (2010-2021). The categorical Food Dollar Series data is only available for the “reference years” 1997, 2002, 2007, and 2012. As a result, I had to narrow my study to the years 2010-2015, applying 2007 data to the years 2010 and 2011, and 2012 data to the years 2012-2015. This aggregation of data again caused issues with degrees of freedoms. The purpose of this paper was to examine the overall impact of surplus costs rather than how they change over time, so this issue could be accepted.

Another problem with this data was statistical significance. As displayed in Figure 3, many of the variables in the series are highly correlated, so in many of the regressions the results for their impact on retail prices are invalid. Even though the impact of surplus costs on retail prices is consistent throughout several regressions, the data from the Food Dollar Series was not fully sufficient for this analysis.

Despite this, the Food Dollar Series provides a comprehensive breakdown of the major factors that consistently impact prices. Unfortunately, food prices can be volatile, and are often susceptible to economic, environmental, or informational shocks, such as wars, disease, or inflationary expectations. Many of these factors are difficult to quantify and capture in a study such as this.

5.3 Potential Future Research

Many of these limitations allow for various of future research opportunities in relation to the surplus costs of food. This study was conducted only at the national level, although food costs and prices often differ by state and region. ReFED’s food surplus data is also available at the state level, and the BLS also captures food prices by region. I was unable to find food price and defined food cost data at the state level, although it still may exist. Analyzing the effects of surplus costs on prices at different regions across the country is a potential avenue for future research combining data sources used in this paper. An additional possible study using the present data is assessing the impact of food surplus costs at other levels of the supply chain on prices. This paper only analyzes costs at the retail level, to see a direct effect on retail prices; this does not discount the fact that waste at the production or residential levels may also influence prices, especially considering most waste in America comes from households. This would demonstrate how consumers themselves impress upon the prices of the goods they purchase. Since this study uses panel data, the results report the overall effect of surplus costs of prices. Surplus costs vary heavily by food type, and their influence on price may change because of this. Future research could compare how these effects differ by food type or category.

I also hope to provide directionality for researchers interested in food surplus and their costs, but do not wish to use the present data. One limitation of this paper is the correlation between some of the variables for the defined costs of food. Future research could impress other explanatory variables into the analysis, such as GDP, imports and exports, unemployment, or poverty rate (for specific regions), or CPI. Some variables that may be harder to quantify but certainly influence food prices are environmental conditions/degradation or global military conflicts (such as Russia’s invasion of Ukraine).

Although the usage of the Food Dollar Series data in this paper has flaws, the data itself could be used in another regard. The USDA Economic Research Service obtained the food category-specific data through IO data from the Bureau of Economic Analysis. Although the series only provides this data for “benchmark years” 1997, 2002, 2007, and 2012, the BEA provides this data annually. Unfortunately, extensive calculation must be invoked to prepare the data for usage in a study like this, and I did not have the opportunity for such an analysis during the process of this study. This, however, provides a clear avenue for future research on revising this study.

Finally, the outcome of this study shows that, at least at the retail level, food waste is correlated to prices, which would classify it as an economic cost. This finding can be a basis for both future research and policy on food price determination.

Food waste as an academic study is still relatively new. As policymakers begin to highlight the importance of food waste more and more in the next few years, new information and data will become available. The usage of this data will be imperative as the US seeks to decrease the amount of food entering landfills and incineration facilities by 50% by 2030. Understanding and reducing food waste is only a possibility if research remains expansive, covering a wide range of attributes from numerous perspectives.

Conclusion

This study quantitatively analyzed the association between food surplus costs and retail prices over the years 2010-2015. The model results suggest that there is a small, but positive association between surplus costs and prices. The United States has adopted the goal of reducing food waste over the next decade for a multitude of reasons, including minimizing resource use and reducing GHG emissions. If food waste is not reduced, consumers will continue to pay the costs not only for what they do not eat but also for what they do. This analysis provides further support for the economics incentives to eliminating food waste.

References

Adjemian, M., Shawn, A., Meyer, S., & Salin, D. (2023). Factors affecting recent food price inflation in the United States. Applied Economic Perspectives and Policy. Applied Economic Perspectives and Policy: Early View (wiley.com)

Baker, Q. & Zachary, J. (2023). Food Dollar Series. USDA Economic Research Service. USDA ERS – Food Dollar Series

BEA (2023). Industry Economic Accounts. US Department of Commerce Bureau of Economic Analysis. Industry Economic Accounts | U.S. Bureau of Economic Analysis (BEA)

BLS (2023). Average Retail Food and Energy Prices, U.S. and Midwest Region. US Bureau of Labor Statistics. Average Retail Food and Energy Prices, U.S. and Midwest Region : Mid–Atlantic Information Office : U.S. Bureau of Labor Statistics (bls.gov)

Columbia Climate School (2019). The Hidden Costs of Food Waste. Columbia University. The Hidden Costs of Food Waste (columbia.edu)

Ellen MacArthur Foundation (2012). Circular Economy. Ellen MacArthur Foundation. What is a circular economy? | Ellen MacArthur Foundation

EPA (2019). 2019 Wasted Food Report. United States Environmental Protection Agency. 2019 Wasted Food Report (epa.gov)

Fasanya, I. & Olawepo, F. (2018). Determinants of Food Price Volatility in Nigeria. Agricultura Tropica et Subtropia, 51(4), p.p. 165-174. Determinants of food price volatility in Nigeria (sciendo.com).

FDA (2023). Food Loss and Waste. United States Food and Drug Administration. Food Loss and Waste | FDA

Feeding America (2023). Hunger in America. Feeding America. Hunger in America | Feeding America

Gikandi, L. (2021). 10% of all greenhouse gas emissions come from food we throw in the bin. World Wildlife Fund. 10% of all greenhouse gas emissions come from food we throw in the bin (panda.org)

Goerge, C. & Tomer, A. (2021). Beyond ‘food deserts’: America needs a new approach to mapping out food insecurity. The Brookings Institute. Beyond ‘food deserts’: America needs a new approach to mapping food insecurity | Brookings

Irz, X., Niemi, J., & Liu, X. (2013). Determinants of Food Price Inflation in Finland – The Role of Energy. Energy Policy, 63, p.p. 656-663. Determinants of food price inflation in Finland—The role of energy – ScienceDirect

Ishangulyyev, R., Kim, S., & Lee, S. (2019). Understanding Food Loss and Waste – Why Are We Losing and Wasting Food? Foods, 8(8). Understanding Food Loss and Waste—Why Are We Losing and Wasting Food? – PMC (nih.gov)

Joiya, S. A., & Shahzad, A. A. (2013). Determinants of high food prices: The case of Pakistan. Pakistan Economic and Social Review, 51(1), p.p. 93–107. DETERMINANTS OF HIGH FOOD PRICES: The Case of Pakistan on JSTOR

Karpyn, A., Riser, D., Tracy, T., Wang, R., & Shen, Y. (2019). The changing landscape of food deserts. United Nations System Standing Committee on Nutrition, 44, p.p. 46-53. The changing landscape of food deserts – PMC (nih.gov).

Martin, A. (2023). Food Prices and Sending. USDA Economic Research Service. USDA ERS – Food Prices and Spending.

Moynihan, E., Charalampos, A., Siddiqui, S., & Neff R. (2022). Optimization Based Modeling for the Food Supply Chain’s Resilience to Outbreaks. Frontiers in Sustainable Food Systems, 6. Frontiers | Optimization Based Modeling for the Food Supply Chain’s Resilience to Outbreaks (frontiersin.org)

Marchant, N. (2023). The world’s food waste problem is bigger than we thought – here’s what we can do about it. World Economic Forum. Global food waste twice the size of previous estimates | World Economic Forum (weforum.org).

Oral, I., Cakici, A., Yildiz, F., & Alayoubi, M. (2023). Determinants of Food Price in Turkey: A Structural VAR Approach. Cogent Food and Agriculture, 9(1). Full article: Determinants of food price in Turkey: A Structural VAR approach (tandfonline.com)

Papargyropoulou, E., Lozano, R., Steinberger, J. K., & Ujang, Z. (2014). The

food waste hierarchy as a framework for the management of food surplus and food waste. Journal of Cleaner Production, 76(2014), 106-115. https://www.sciencedirect.com/science/article/pii/S0959652614003680

Ploeg, M., Nulph, D., & Williams, R. (2011). Mapping Food Deserts in the United States. USDA Economic Research Service. USDA ERS – Data Feature: Mapping Food Deserts in the U.S.

ReFED (2023). Food Waste Monitor. ReFED. ReFED – Food waste monitor

Shah, A. (2018). Asdoc: Sends STATA output to MS Word. Stata.Professor. asdoc : Sends Stata output to MS Word – Stata.Professor : Your Partner in Research (fintechprofessor.com)

Usmani, Z., et. al. (2021). Minimizing hazardous impact of food waste in a circular economy

– Advances in resource recovery through green strategies. Journal of Hazardous Materials, 416(2021). https://www.sciencedirect.com/science/article/pii/S0304389421011183.

Viscardi, S., Colicchia, C. & Creazza, A. (2023). Circular economy and food

waste in supply chains: a literature review. International Journal of Logistics Research and Applications, 26(5), 589-614. https://doi.org/10.1080/13675567.2022.2128095.

Appendix

8.1 Definitions

Average Retail Price: US city average retail price for all food items present in study.

Food Surplus Costs: The perceived value of all surplus food at the retail level of the supply chain.

Food Waste: Uneaten food and inedible parts that end up being anaerobically digested, composted, landfilled, incinerated, disposed of down the sewer, dumped, spread onto land, or simply not harvested.

Food Surplus: All food that goes unsold or unused by a business or that goes uneaten at home – including food and inedible parts (e.g., peels, pits, bones) that are donated, fed to animals, repurposed to produce other products, composted, anaerobically digested, or wasted.

Food Dollar: Total annual market value for all purchases of domestically produced food by persons living in the United States.

Agribusiness: All establishments producing farm inputs (except those described in other industry groups) such as seed, fertilizers, farm machinery, farm services, and all subcontracting establishments.

Farm production: All establishments classified within the agriculture, forestry, fishing, and hunting industries.

Packaging: All establishments classified within the packaging, container, and print manufacturing industries, and all subcontracting establishments.

Transportation: All establishments classified within the freight services industries and all subcontracting establishments.

Wholesale Trade: All nonretail establishments reselling products to other establishments for the purpose of contributing to the U.S. food supply and all subcontracting establishments

Retail Trade: All food retailing and related establishments and all subcontracting establishments.

Foodservices: All eating, drinking, and related establishments as well as all subcontracting establishments.

Energy: Oil and coal mining, gas and electric utilities, refineries, related establishments, and all subcontracting establishments.

Finance and Insurance: All financial services and insurance carrier establishments and all subcontracting establishments.

Advertising: All advertising services and related establishments and all subcontracting establishments.

Legal and Accounting: Establishments providing legal, accounting, and bookkeeping services, as well as all subcontracting establishments.

Food Types Included in Study: Apples, bacon, bananas, beans, beef roast, bell peppers, broccoli, butter and margarine, cheese, cherries, chicken breast, chicken legs, coffee, cookies, eggs, flour fresh chicken, fresh milk, frozen turkey, grapefruit, ground beef, ham, lemons, lettuce, oranges, pasta, peaches, pears, pork, potatoes, sliced bread, steak, strawberries, sugar, and tomatoes.

Food categories: Bakery products, beef, pork, and other meats, poultry, fresh milk, processed dairy products, eggs, fresh fruits, fresh vegetables, sugar and sweets, other foods, non-alcoholic beverages.